Debt Defense

By NWCLC Staff

•

February 2, 2024

Credit scores and Debt Collection. The two are often linked together as they are a significantly impact individuals’ financial well-being. Understanding this connection is crucial for anyone navigating the challenges of debt collection. In this blog post, we’ll be discussing the relationship between debt collection and credit scores, learning more about the impact and seeing…

The post Navigating Debt Collection: Unraveling the Impact on Credit Scores appeared first on Northwest Consumer Law Center.

By NWCLC Staff

•

February 2, 2024

Dealing with debt collection can be a daunting experience, causing stress and anxiety for individuals already facing financial challenges. This year, debt collection cases were our highest margin. We understand the complexities of this process and are here to guide you through the maze of debt collection. In this blog post we’ll explore the intricacies…

The post Dealing With Debt Collection appeared first on Northwest Consumer Law Center.

By NWCLC Staff

•

August 14, 2023

Have you ever looked at your credit and noticed that something was off? It may be that you do not recognize a debt or that your home address is wrong. Even if this hasn’t happened to you, accurate credit reporting is a huge factor in your financial well-being. A clean and precise credit report is…

The post Disputing Errors on Your Credit Report appeared first on Northwest Consumer Law Center.

By NWCLC Staff

•

August 8, 2023

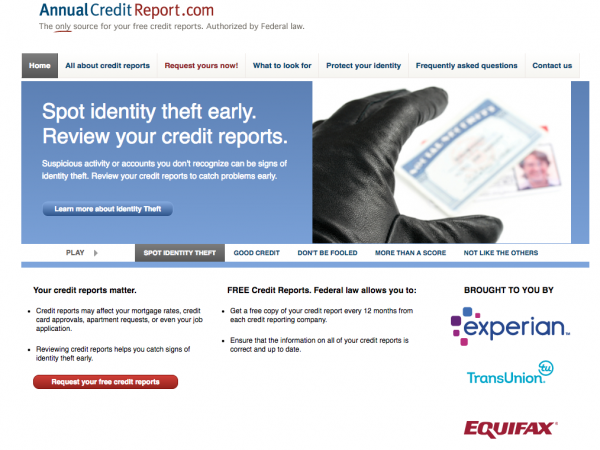

You probably heard how important credit scores are about a million times, however it doesn’t hurt to hear it again! Credit scores are a powerful tool and knowing what your score is essential to your financial well-being. Let’s get started on how we can obtain a free credit report! Before diving in, it’s essential to…

The post How to Obtain Your Free Credit Report appeared first on Northwest Consumer Law Center.

By NWCLC Staff

•

January 5, 2023

Samantha reached out to NWCLC after she was served with a debt collection lawsuit for a $17,000 loan. Samantha experienced very difficult times during COVID and needed the loan to pay for medical bills and to get her car fixed after an accident. All this caused Samantha to feel “stressed, nervous, and quite intimidated before contacting NWCLC.” Samantha thought the loan was for $6k, so she wanted to hire NWCLC to investigate since the debt collector was charging twice the amount. After discovery, NWCLC found that the debt collector was charging a usurious interest rate and was able to negotiate a great settlement on Samantha’s behalf. Here’s what Samantha had to say about NWCLC, “Attorney Alyssa and the legal team at NWCLC provided excellent service and are client-oriented…She (Alyssa) understood the intricacies regarding my legal matter which helped in negotiating a favorable settlement. I felt relieved after coming to a close of a stressful situation and content with the terms.”

By NWCLC Staff

•

August 19, 2022

When Stacie* first reached out to NWCLC, she was unemployed and struggling with debt. When she finally found employment, she decided to double down on filing for bankruptcy to get the fresh start she needed for her new life, especially after an out-of-state collector sued her. She knew that even with her new job she would never be able to pay the bills that accumulated while she was unemployed. With NWCLC’s representation for her Chapter 7 bankruptcy, Stacie was able to discharge $70,000 worth of debt and got the fresh start she deserved. She was able to start her new job in a clean financial state. *Names and identifying facts have been changed

By NWCLC Staff

•

August 19, 2022

Marie Ann originally reached out to NWCLC after being served with two debt cases seeking almost $20,000 in debt that Marie Ann couldn’t afford to pay on her modest salary. The credit card debt belonged to her wife, but due to after her tragic passing, Marie Ann was unfortunately left with the debt. Feeling anxious, she came to us for help. We sat down with Marie Ann and reviewed all of her options with her. Marie Ann decided that earning a fresh start through bankruptcy would be her best choice. We helped Marie Ann get rid of over $87,000 of debt that would have left her struggling for a very long time. Marie Ann is now able to move forward with a fresh financial start.

By NWCLC Staff

•

August 19, 2022

Rachel first reached out to us for advice on how to respond to a debt defense lawsuit from a big brand-named bank that had left her feeling stressed and devastated. To help, we provided brief advice on how to respond to the lawsuit and also discussed bankruptcy as another option for her to discharge the debt. About two weeks later, Rachel came back to us after deciding that bankruptcy was the best solution to get rid of the debt. Rachel was unemployed and recently moved to a new city, so she liked the idea of filing for bankruptcy to get the fresh start she needed. NWCLC filed Chapter 7 on her behalf and was able to discharge $39,414.40 in debt. Rachel said that “it feels like a huge weight being taken from my shoulders, and I am now able to start my new life debt free.”

By NWCLC Staff

•

June 21, 2022

Georgia* came to us after she was served by a debt collector. She was told that she had to show up in court in a completely different county than where she lived. It was for an old medical debt that she recognized, but thought had been taken care of by insurance. She went to court…

The post Old Debt Comes Back appeared first on Northwest Consumer Law Center.

By NWCLC Staff

•

June 21, 2022

Olivia* received the summons and complaint for this case in the middle of the pandemic for private student loan debt from over 5 years ago. The client had a bad period where she was suffering from a medical condition where she was not able to make regular payments on the card. The debt buyer sued to collect $8,000. After pushing hard for discovery, OC agreed to discuss settlement. NWCLC was able to settle for a full discharge of the debt, removal of the tradeline on her credit reports, and payment to the client in the amount of $2,000.00. *Names and Identifying facts have been changed